Military Retirement Benefit Letter

benefit letter military wallpaperThe military retirement system is a funded noncontributory defined-benefit plan 1 Historically military retirement benefits were as unfunded liability on the US. Please sign in to get your VA benefit letters Try signing in with your DS Logon My HealtheVet or IDme account.

Retirees cannot claim both the military retirement exemption and the 6000 exemption for traditional IRA distributions.

Military retirement benefit letter. Military Survivor Benefit Plan SBP Reserve Component Survivor Benefit Plan RCSBP Retired Servicemans Family Protection Plan RSFPP Minnesota State Tax Subtraction. Military Retirement Pay is Exempt from all Arkansas State Taxes. A world class pension scheme for your military service.

Beginning with tax year 2016 Minnesota will allow taxpayers to subtract Survivor benefit plan payments including payments to a former Spouse as part of a court order when calculating Minnesota taxable income and. Therefore taxpayers lack comparable facts to Treas. Fast Start Direct Deposit.

If the retiree elected the Survivor Benefit Plan you will also receive the forms to start SBP Annuity payments. When most people talk about military retirement they focus on the retirement pay. Also called High-36 or military retired pay this is a defined benefit plan.

7 things every spouse should know about military retirement benefits 1. Its calculated at 25 times your highest 36 months of basic pay. The military member is still subject to recall and activation.

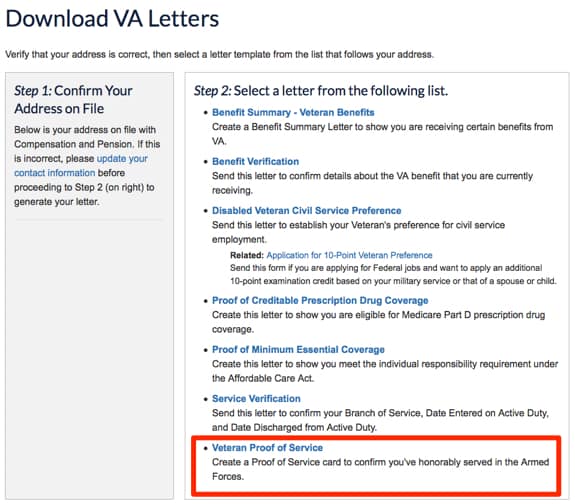

They therefore apply for voluntary retirement by giving notice of sufficient period. Early in the letter give a specific date for your retirement. Access and download your VA Benefit Summary Letter sometimes called a VA award letter and other benefit letters and documents online.

The taxpayer must attach the Defense Finance and Accounting Service DFAS Letter and the appropriate copies of the Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc to claim a refund of taxes paid on the excludable amount before adjusting the military retirement pay from taxable to non-taxable. In these cases there is no VRS scheme or requirement of number of years of service. 1122-1d Example 4 to compute the excludable portion of disability retirement pay.

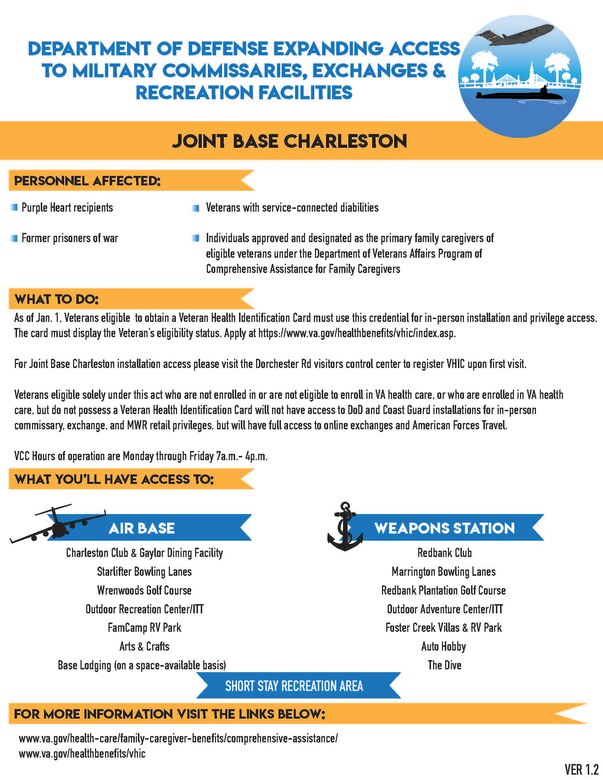

A recent GAO review of active duty military benefits noted that when comparing the types of benefits offered by the military with those offered in the private sector all the core benefits offered by most private sector firms-retirement pay health care life insurance and paid. Because military retirement pay ends with the death of the service member the. In terms of retirement plans military members are able to participate in both a pension plan defined benefit plan and a TSP plan defined contribution plan.

The DOD had not made a disability determination. What you call retirement pay pension is actually retainer pay both the IRS and DOD call it reduced pay for reduced services. At the very least include the number of years you worked for the company to remind your boss of your many contributions.

When a member of the armed forces reaches their retirement age they receive one of the most generous pensions available in the UK. Taxpayers exclude the VA disability benefit twice from taxable military retirement income. The pension plan pays monthly checks for the rest of a servicemembers life after retirement and the TSP account functions similar to a 401K Plan.

To receive some benefits Veterans need a letter proving their status. Retiree Change of AddressState Tax Withholding Request. This will help both you and your employer avoid putting off your retirement.

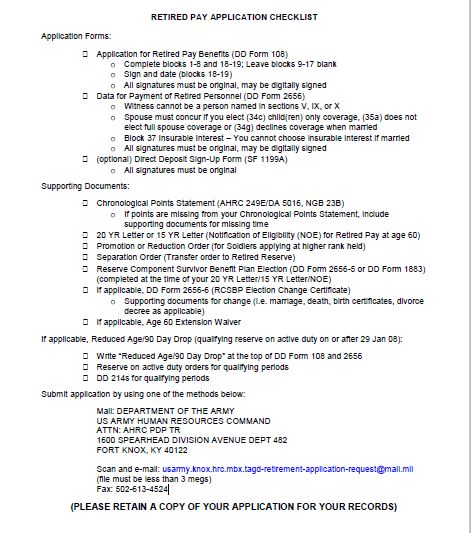

Retirement Request letter is also written by a person wishing to change the job for better prospects by giving a notice in advance of sufficient period. You might consider concisely reviewing the value you added to the company over the years in your letter. Retirement Application - Data for Payment of Retired Personnel.

All military retirements are protected from inflation by an annual Cost of Living Adjustment COLA based on changes in the Consumer Price Index CPI as measured by the Department of Labor. Condolence Letter with SF 1174 - Arrears of Pay form and SBP Startup Forms Within 30 days after reporting the death of a retiree to DFAS you should receive a letter containing the SF 1174 form to claim the retirees Arrears of Pay. The military member still has to abide by and answer to the Uniformed Code of Military Justice.

Effective October 1 1984 congress established the Department of Defense Military Retirement Fund Fund administered by the Secretary of the Treasury to be used for the accumulation of funds to finance military retirement liability of the Department of Defense. Veterans are eligible for full concurrent receipt of TDIU benefits and retired pay if they are a military retiree who meets all of the above-mentioned eligibility requirements as well as both of the following. Youll need to serve 20 years or more to qualify for the lifetime monthly annuity.

Your retirement benefit is determined by your years of service. Beginning with tax year 2018 retirement benefits received by a member of the uniformed services as defined are exempted from income tax. Retired Military Pay Accounts.

They are rated by VA as unemployable ie TDIU status They are in receipt of VA disability compensation as a result of TDIU. Banking and Checking Forms. Application for Correction of Military Record.

Mention your successes at the company. Application for Death Benefits Civil Service Retirement System Standard Form 2800 dated June 2006 Documentation and Elections in Support of Application for Death Benefits Civil Service Retirement System When Deceased Was an Employee at the Time of Death Standard Form 2800A dated June 2006 Applying for Death Benefits Under the Civil Service Retirement System Standard Form 2800-1 dated. The Military has a wide variety of benefits ranging from complete health care to commissary and exchange shopping.